ARQ Wealth Advisors Q4 2023 Commentary: Year in Review

By Richard Siegel, CFP®

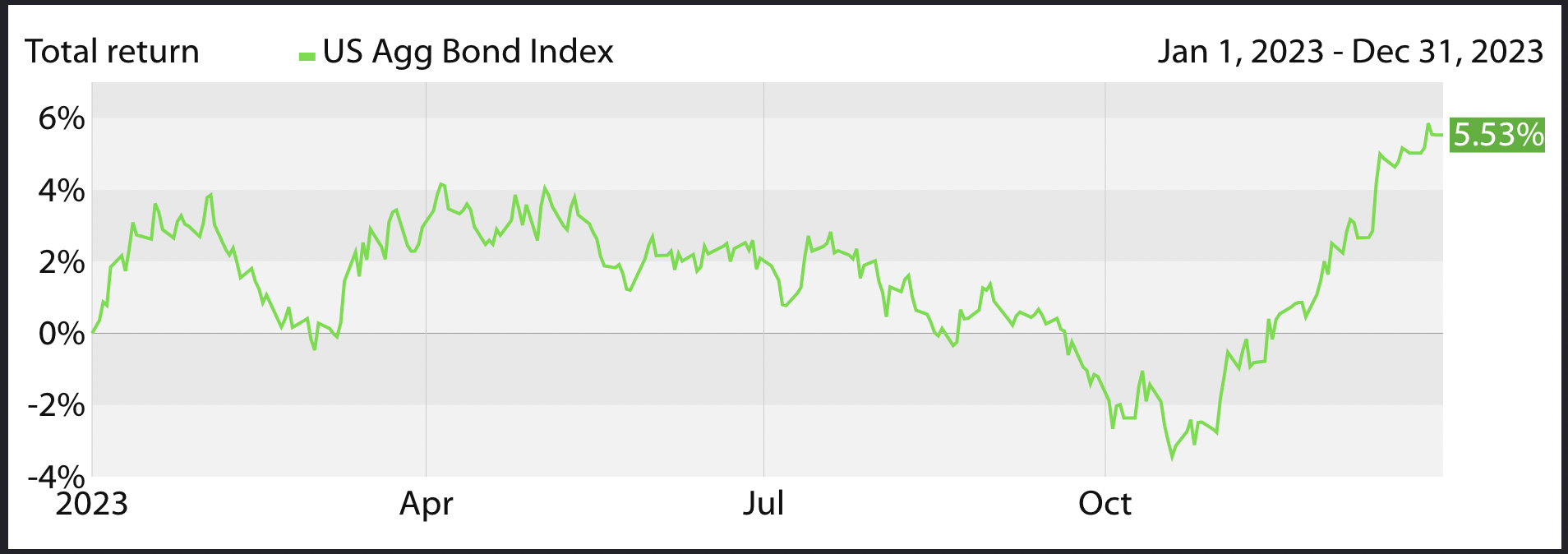

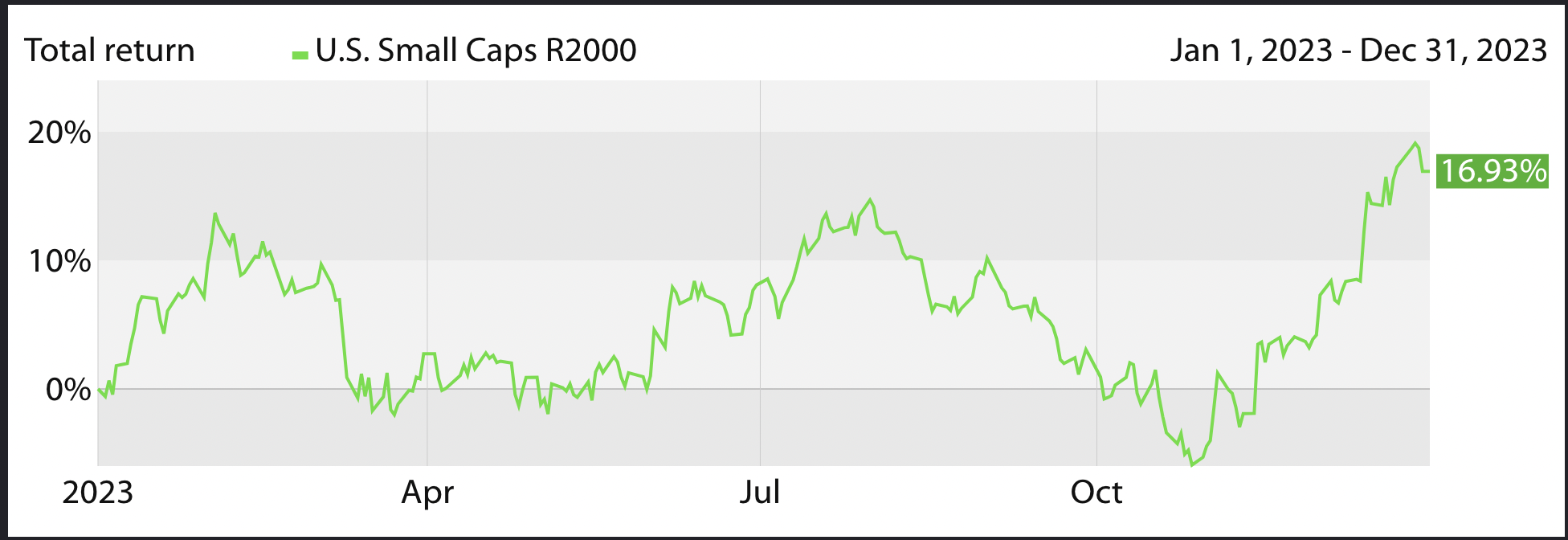

2023 is a perfect example of why long term investors need to stay invested. Going into the year, the vast majority of market prognosticators, talking heads, strategists and fund managers were negative on the economy and market outlook for 2023. Why wouldn’t they be? After all, restrictive Fed monetary policy, inflationary pressures, struggling corporate earnings, an inverted yield curve, geopolitical turmoil, and partisan budgetary fighting are all bad for the markets, right? Don’t get me wrong, the path to strong returns was not easy. In fact, both the stock and bond markets saw some crazy whipsaw action throughout the year. In the first 4 weeks of the year, the bond market was up 4%, only to lose it all in the next 4 weeks, get it all back over the next 5 weeks, then drop 8% over the next 6 months, and for the grand finale gain 9% in the last 2 months of the year. If you think that’s wild, the Russell 2000 small cap index followed a similar pattern, but with 5 moves of approximately 14% to 20% each. Indeed, 2023 was not for the faint of heart.

2023 is a perfect example of why long term investors need to stay invested. Going into the year, the vast majority of market prognosticators, talking heads, strategists and fund managers were negative on the economy and market outlook for 2023. Why wouldn’t they be? After all, restrictive Fed monetary policy, inflationary pressures, struggling corporate earnings, an inverted yield curve, geopolitical turmoil, and partisan budgetary fighting are all bad for the markets, right? Don’t get me wrong, the path to strong returns was not easy. In fact, both the stock and bond markets saw some crazy whipsaw action throughout the year. In the first 4 weeks of the year, the bond market was up 4%, only to lose it all in the next 4 weeks, get it all back over the next 5 weeks, then drop 8% over the next 6 months, and for the grand finale gain 9% in the last 2 months of the year. If you think that’s wild, the Russell 2000 small cap index followed a similar pattern, but with 5 moves of approximately 14% to 20% each. Indeed, 2023 was not for the faint of heart.

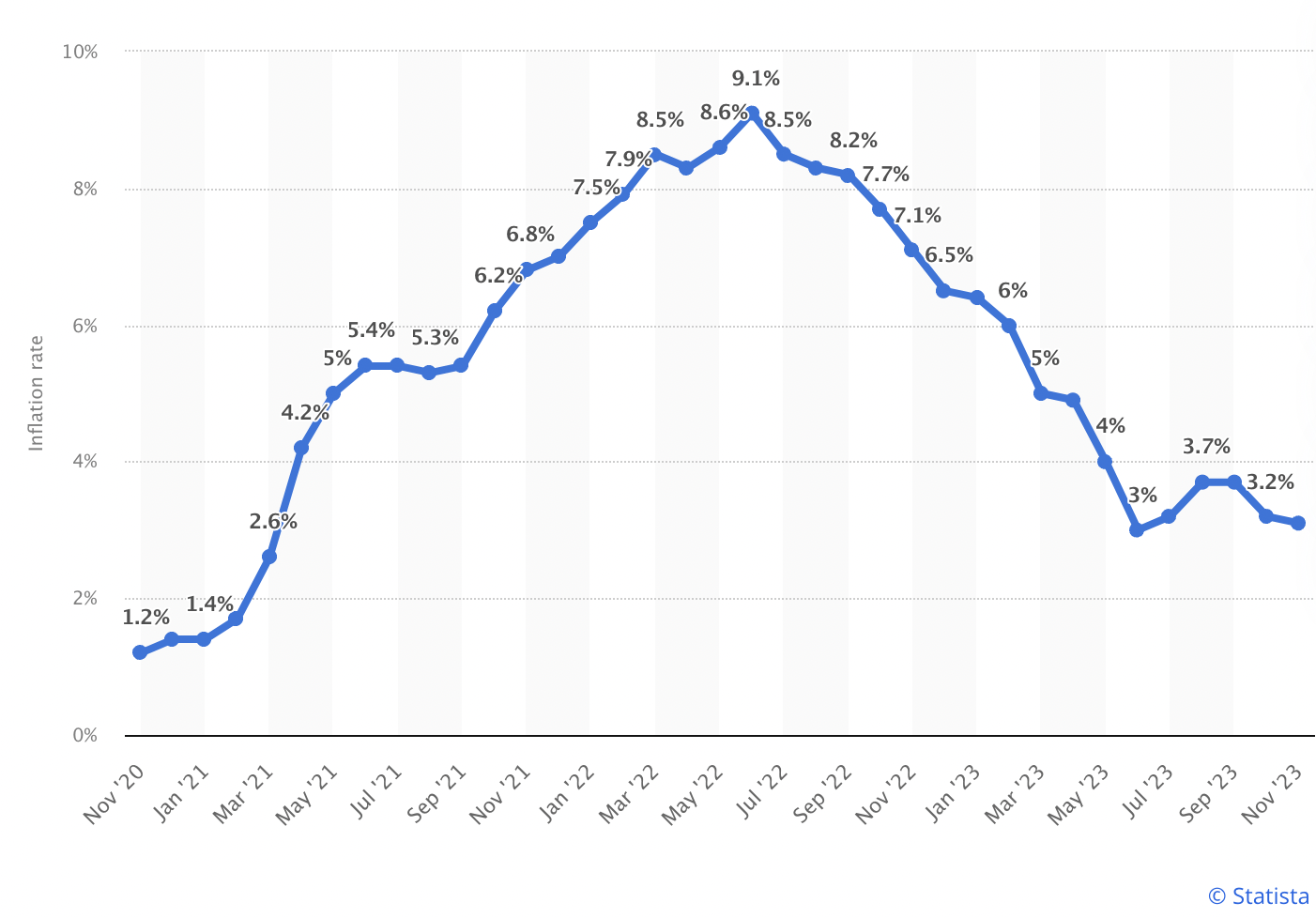

As the year progressed, some interesting trends began to emerge; inflation dropped significantly, the Fed communicated that they were done raising rates and would begin lowering them in 2024, the economy defied a much anticipated recession led by a strong consumer and a tight labor market.

As the year progressed, some interesting trends began to emerge; inflation dropped significantly, the Fed communicated that they were done raising rates and would begin lowering them in 2024, the economy defied a much anticipated recession led by a strong consumer and a tight labor market.

To sum up the year, the Fed was a source of stress and angst for the markets all year long until the 4th quarter, when it provided a catalyst for both stocks and bonds with the promise of lower rates in the new year.

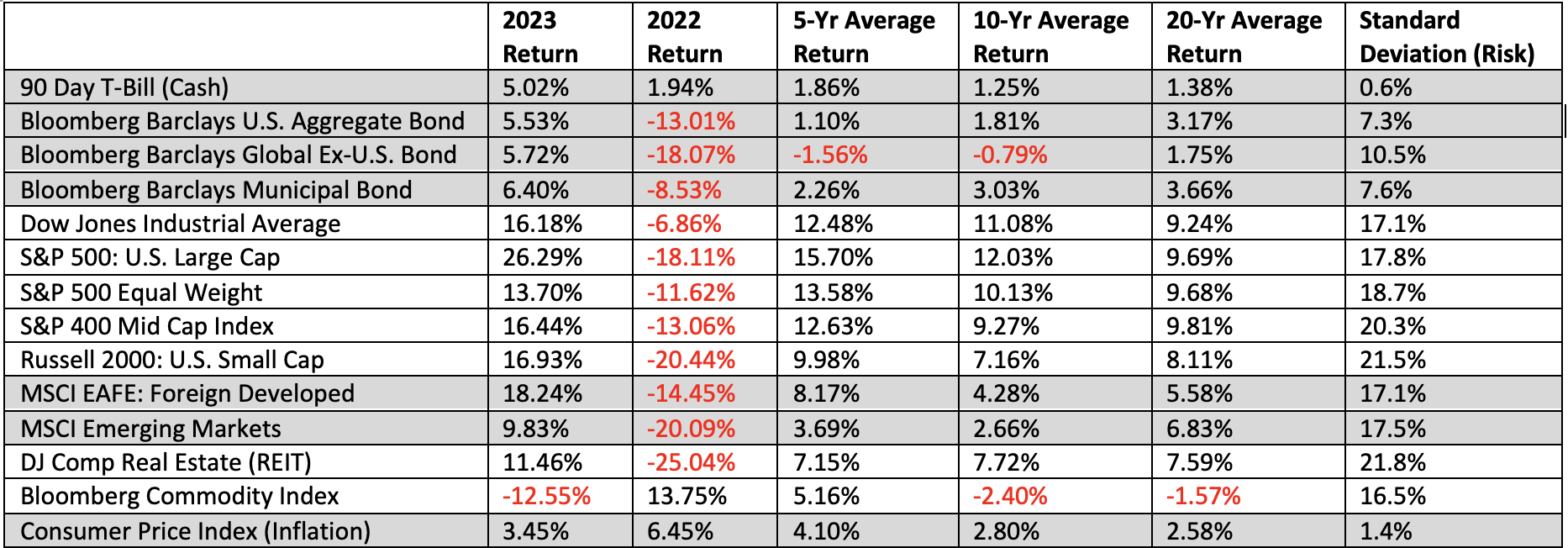

The table to the right shows the stark contrast in performance between 2022 and 2023. Every year at this time we like to show returns of the capital markets over the short, intermediate and long-term, because we can glean such valuable perspective. For example, over the past 20 years inflation has averaged 2.58%, while cash has returned 1.38%. Has cash been a viable investment over the past 5, 10, or 20 years? We say “of course not.” Now take a look at the various equity markets over the long run; on average, most stock markets have returned right around 9%. There have been structural issues with bond returns over the intermediate and longer-term based on the financial engineering imposed by central banks in response to the Great Financial Crisis and Covid. We do not expect a repeat of these anemic returns based on current monetary policy and the current interest rate environment.

The table to the right shows the stark contrast in performance between 2022 and 2023. Every year at this time we like to show returns of the capital markets over the short, intermediate and long-term, because we can glean such valuable perspective. For example, over the past 20 years inflation has averaged 2.58%, while cash has returned 1.38%. Has cash been a viable investment over the past 5, 10, or 20 years? We say “of course not.” Now take a look at the various equity markets over the long run; on average, most stock markets have returned right around 9%. There have been structural issues with bond returns over the intermediate and longer-term based on the financial engineering imposed by central banks in response to the Great Financial Crisis and Covid. We do not expect a repeat of these anemic returns based on current monetary policy and the current interest rate environment.

Economic Overview

Economic Overview

For purposes of summarizing 2023 from an economic standpoint, we’ll focus on 4 metrics: Inflation (CPI), GDP, the job market, and the index of leading economic indicators.

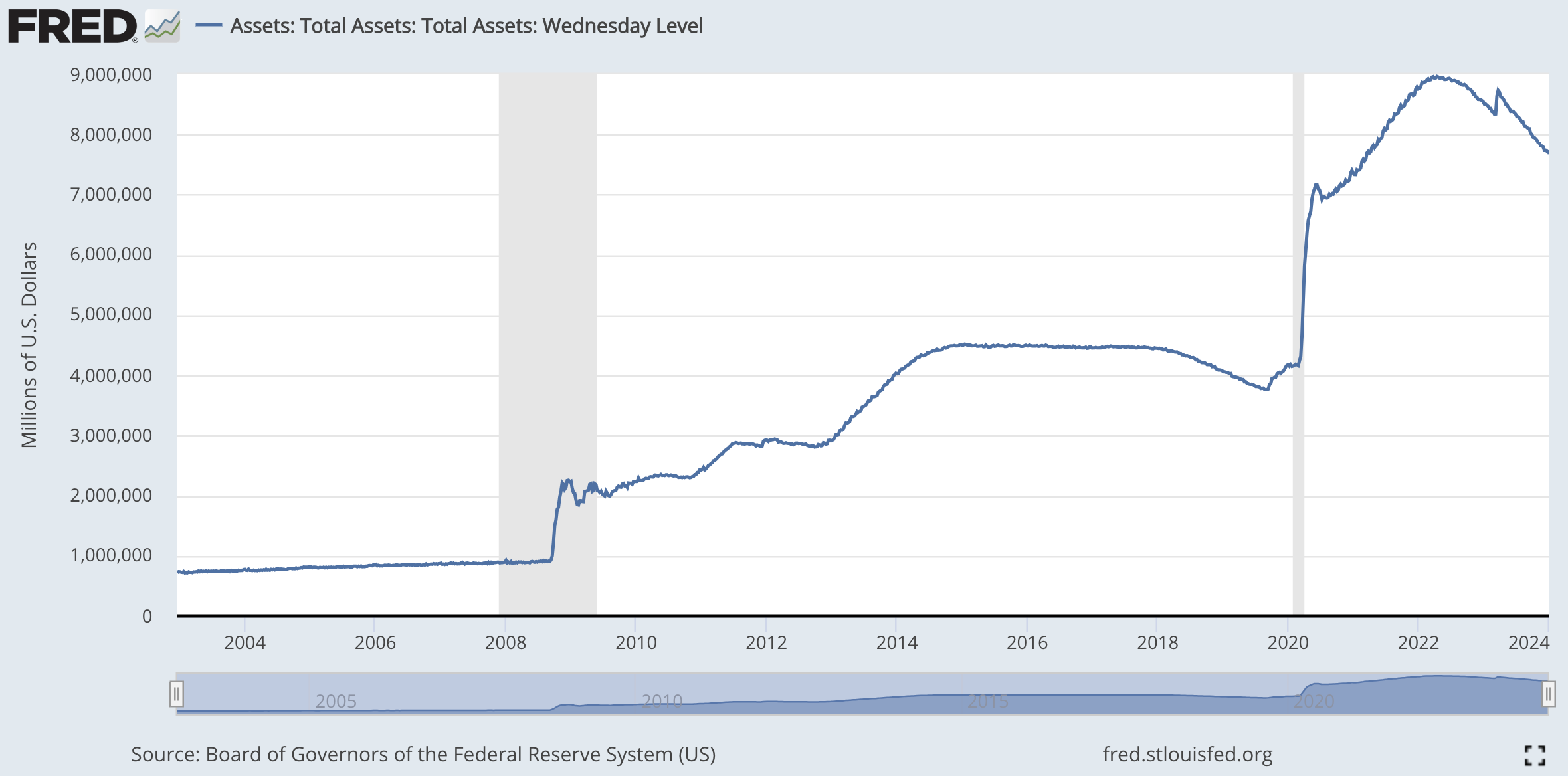

First and foremost, inflation is the reason why the Fed had to take such extreme measures over the past year and a half. Covid era money creation and supply chain issues created the highest inflation rates the U.S. has seen since the early 1980’s. It is our contention that the Fed was a little late in reversing its “easy money” policies, but better late than never. Raising the Fed Funds Rate to 5.5% from 0% along with unwinding its balance sheet was the playbook for getting inflation down to normal levels. So far it has worked, but are we out of the woods? It was a forgone conclusion that the Fed would cause a recession by embarking on such aggressive policies. By Jerome Powell’s own admission, “these actions will bring some pain to households and businesses.” We saw a highly publicized collapse of several regional banks and the unemployment rate moved up from 3.4% to 3.9% (almost 1 million layoffs). So far, a major crisis has been averted, but recession risks remain.

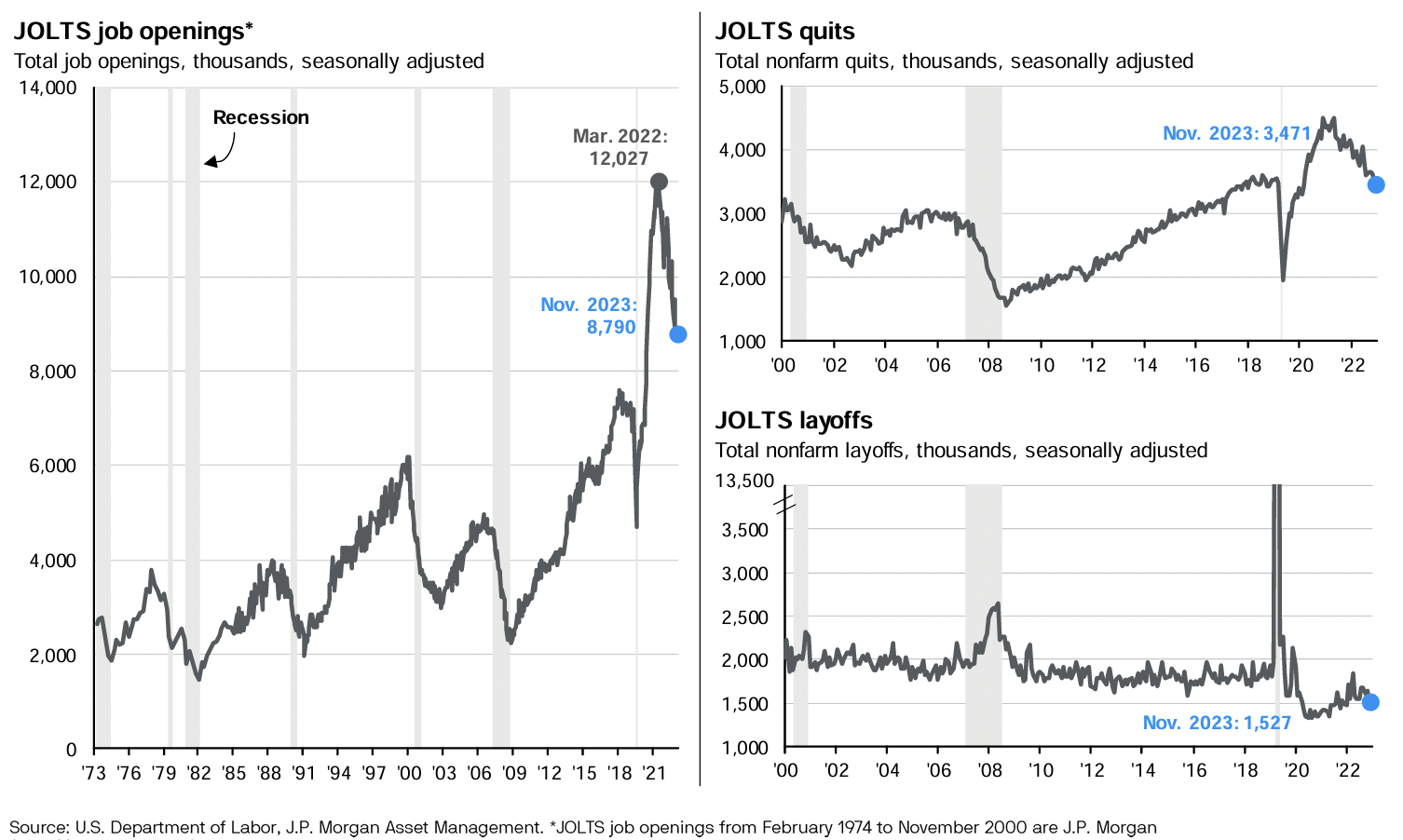

The Conference Board forecasts that for the full calendar year 2023, GDP growth was 2.3%. The board continues to believe that a brief and shallow recession is in the cards for the first half of 2024 caused primarily from inventory drawdowns and an overdue decline in consumer spending. The resilience in consumer spending is related to the super tight labor market. It appears that while the unemployment rate still looks good, the job market is loosening up a bit.

The Conference Board forecasts that for the full calendar year 2023, GDP growth was 2.3%. The board continues to believe that a brief and shallow recession is in the cards for the first half of 2024 caused primarily from inventory drawdowns and an overdue decline in consumer spending. The resilience in consumer spending is related to the super tight labor market. It appears that while the unemployment rate still looks good, the job market is loosening up a bit.

Lastly, we’ll make mention of the LEI (Index of leading economic indicators). This a forward looking index of several data points (building permits, manufacturing orders, stock prices, etc.) used to help predict future economic activity. Historically, it has been a reasonably accurate predictor of recessions and current readings of the index are pointing to a contraction.

Equity Markets Overview

Equity Markets Overview

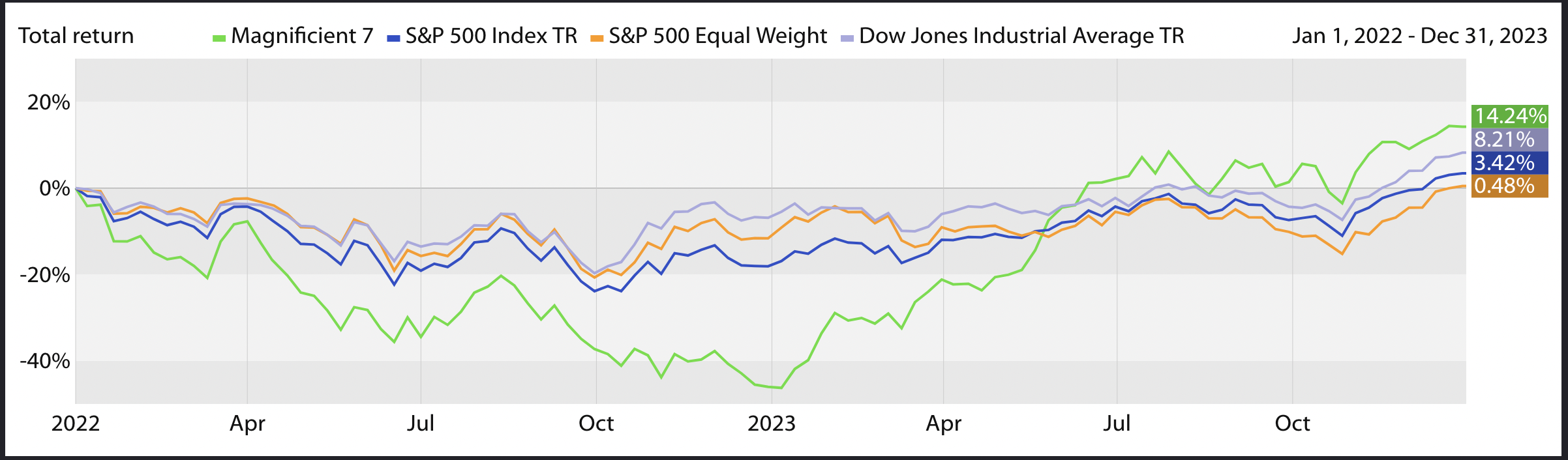

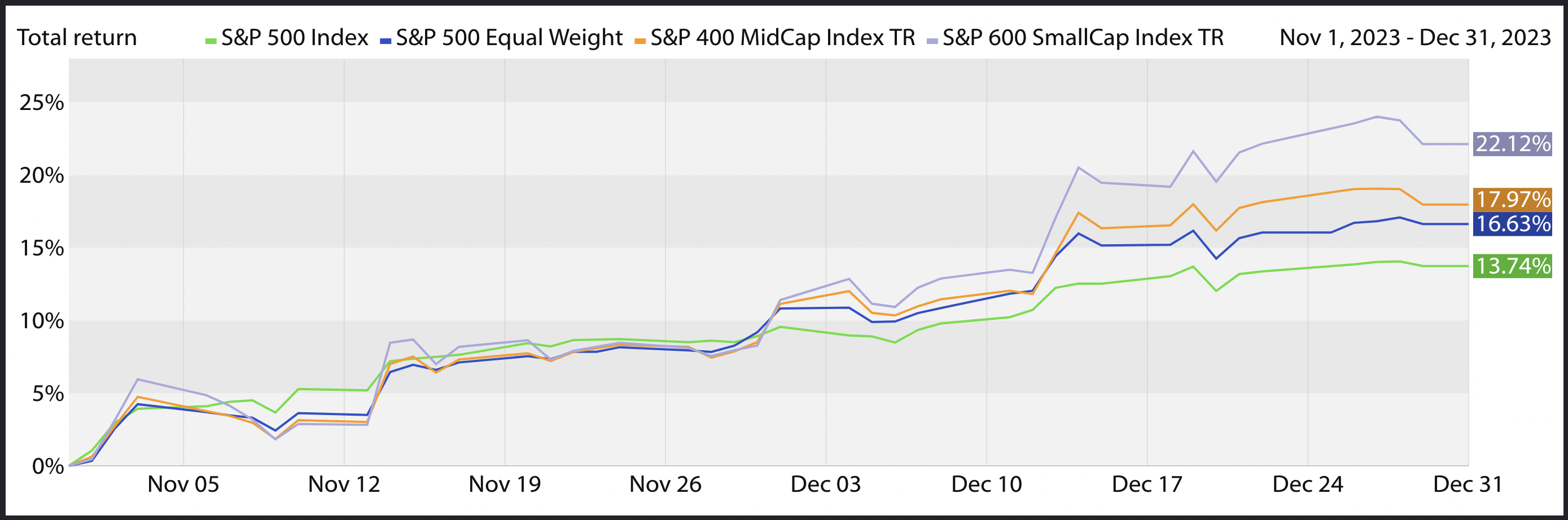

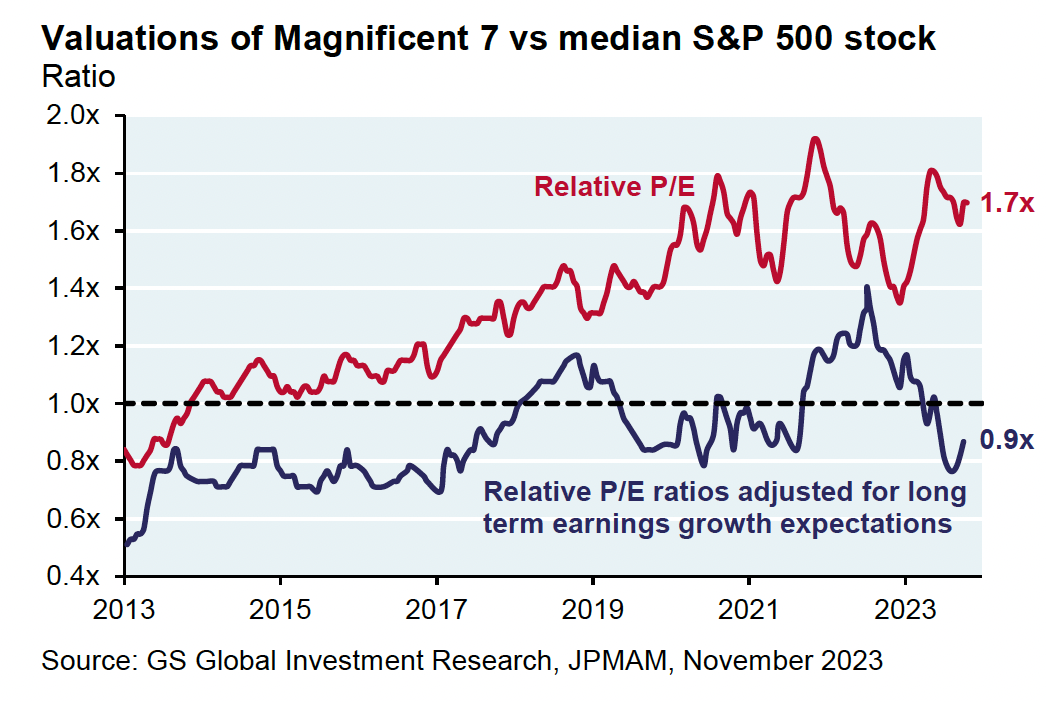

The headline story for 2023 was the lights out performance of the Magnificent 7 stocks (Microsoft, Meta, Google, Amazon, Apple, Nvidia, Tesla). These same stocks got crushed in 2022 and then mounted an amazing recovery over the past 12 months, fueled by exuberance around the AI (artificial intelligence) craze. In fact, by mid-year all of the performance of the S&P 500 was attributed to just these 7 stocks, meaning that the remaining 493 stocks in the index were negative on average. Our portfolio strategies certainly have exposure to these stocks, but not in the same concentration as the S&P 500 Index. Our rationale for the underweight is simply based on their fundamentals. Bottom line: they are very expensive, carry much more risk and volatility than the broader equity markets and their earnings do not justify their performance. All that being said, we maintain exposure to these important companies, but contend that the broadening out of the market in the final two months of 2023 will continue and other stocks/sectors should outperform.

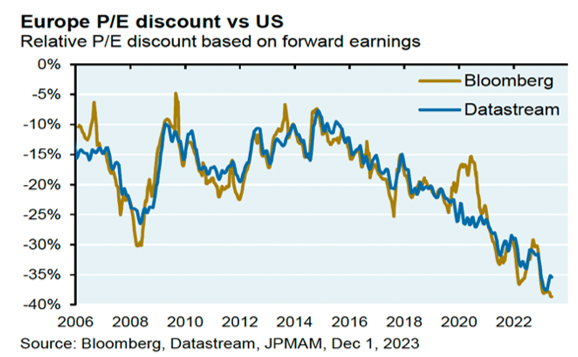

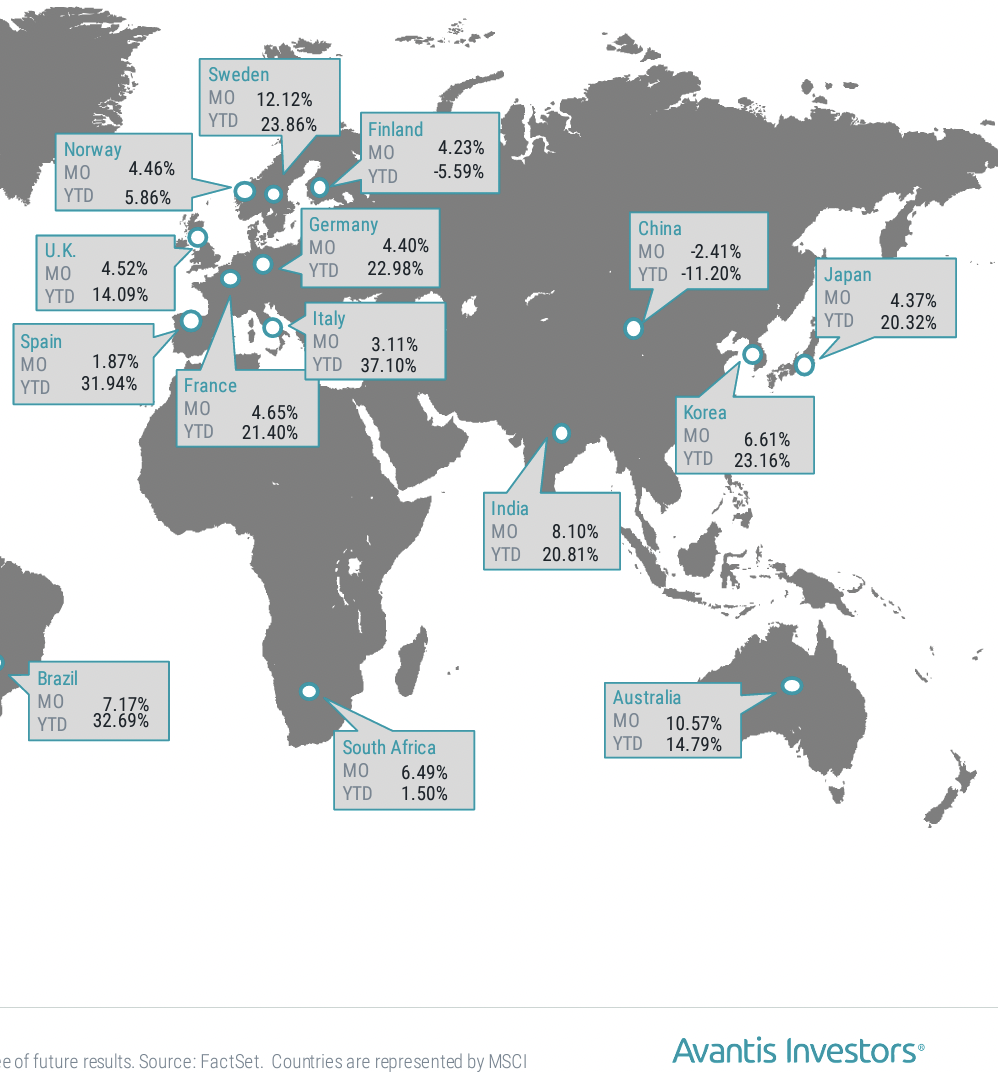

Foreign markets also turned in solid returns in 2023. Europe, Japan and most emerging markets did quite well. China was the big downside surprise as it finally ended its zero-Covid policy, but was unable to get its economy up and running like most developed economies. The vast majority of foreign stock markets continue to look cheap relative to the U.S. market.

Foreign markets also turned in solid returns in 2023. Europe, Japan and most emerging markets did quite well. China was the big downside surprise as it finally ended its zero-Covid policy, but was unable to get its economy up and running like most developed economies. The vast majority of foreign stock markets continue to look cheap relative to the U.S. market.

Overall, our portfolio strategies are slightly underweighted in equities as we continue to hold a risk-free 5%+ yield cash position. Our plan of action is to deploy the cash back into stocks when a corrective pullback brings overall valuations down to more attractive levels. In any given year, 5%+ drops occur about 4 times while 10%+ corrections occur every couple of years, so the opportunities to buy low will be plentiful, especially if the economy begins to falter.

Overall, our portfolio strategies are slightly underweighted in equities as we continue to hold a risk-free 5%+ yield cash position. Our plan of action is to deploy the cash back into stocks when a corrective pullback brings overall valuations down to more attractive levels. In any given year, 5%+ drops occur about 4 times while 10%+ corrections occur every couple of years, so the opportunities to buy low will be plentiful, especially if the economy begins to falter.

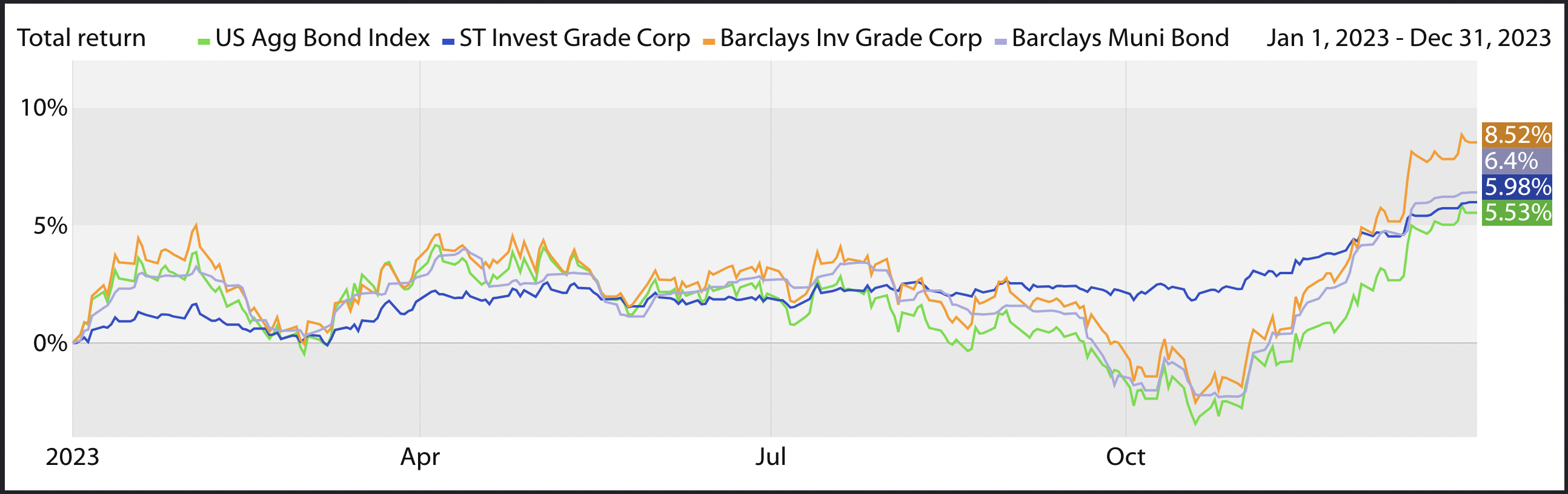

Bond Market Overview

One year ago, we wrote in our year-end commentary “2022 was the worst year of all time for the U.S. Aggregate Bond Index, -13.01%. With the historic losses in the bond market comes opportunity. Lower prices and higher yields are today’s backdrop, the ideal set-up for bond returns on a forward looking basis.” Well, it took several months to play out, but the bond market set-up we were touting finally delivered. For 2023, the U.S. Aggregate Bond Index did not recover all of last year’s losses, but it did recover about 50% of them.

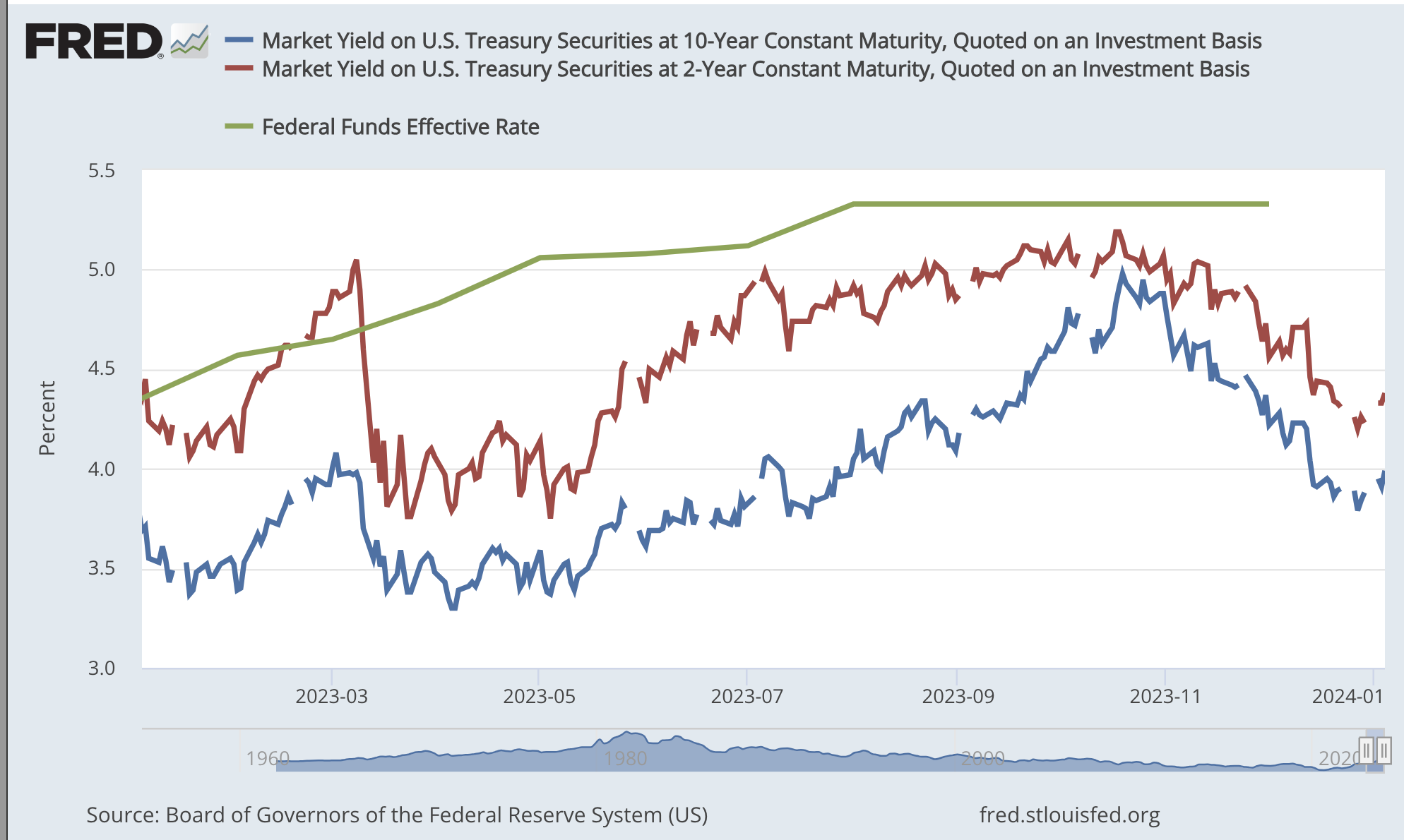

You can easily see from these two charts how bond yields rolled over hard during the last few months of the year and prices moved up impressively.

You can easily see from these two charts how bond yields rolled over hard during the last few months of the year and prices moved up impressively.

Investors perceived Jerome Powell’s comments as dovish after the last FOMC meeting in early December, with markets pricing in expectations that the Fed is likely done raising rates. Powell said it was clear that monetary policy was slowing the economy as expected, with a benchmark overnight interest rate “well into restrictive territory.” He then went on to say, “The question of when it will be appropriate to begin dialing back the policy restraint was clearly a discussion for us at our meeting today.”

Essentially, higher rates are beginning to negatively affect the economy and if they don’t act to unwind the fastest hiking cycle on record, it could mean big trouble for the economy. The Fed began telegraphing that it will start bringing rates down in 2024 and the markets reacted very positively. Like most capital markets, the bond market is forward looking, meaning prices move ahead of actual events.

As we transition into a new year, it would be reasonable to believe that we’ll finally see a normalization from the distortions created by the Covid pandemic. Finally, cash rates could settle in to normal yields of 3-4%, inflation could approach historical averages of 2.5%, equity valuations could mean revert to the 16x-18x earnings level, bond returns should be boring in the 4-5% range, and cheaper stocks should play catch-up and outperform mega-cap tech companies. If 2024 brings a recession, we will look at it as a healthy reset and an opportunity to position more aggressively for a higher returns. Lastly, 2024 brings a highly contentious Presidential election. DO NOT let your political leanings influence how your life savings is invested. History proves that election results have very little impact on the markets, and making adjustments based on one’s political beliefs is usually counterproductive.

As we transition into a new year, it would be reasonable to believe that we’ll finally see a normalization from the distortions created by the Covid pandemic. Finally, cash rates could settle in to normal yields of 3-4%, inflation could approach historical averages of 2.5%, equity valuations could mean revert to the 16x-18x earnings level, bond returns should be boring in the 4-5% range, and cheaper stocks should play catch-up and outperform mega-cap tech companies. If 2024 brings a recession, we will look at it as a healthy reset and an opportunity to position more aggressively for a higher returns. Lastly, 2024 brings a highly contentious Presidential election. DO NOT let your political leanings influence how your life savings is invested. History proves that election results have very little impact on the markets, and making adjustments based on one’s political beliefs is usually counterproductive.

Here’s to a healthy, happy and prosperous 2024!