While net worth is a factor, it’s not the sole determinant of whether you might need a trust. Depending on the type and the needs to be addressed, trusts can benefit families, regardless of their net worth.

Here, we’ll delve deeper into the world of trusts beyond the net worth question to explore the various factors influencing the need for one.

Demystifying Trusts: A Toolbox for Financial Security

At their most basic, trusts are legal constructs where an individual (grantor) transfers ownership of assets to a trustee, who manages them to benefit designated beneficiaries. These assets can encompass a variety of things, from cash and investments to real estate and even intellectual property.

Generally, a trust is a legal arrangement in which you entrust your assets to someone to manage and distribute them according to your wishes.

It’s a powerful estate planning tool that offers flexibility and control over your wealth, especially regarding distribution after your lifetime.

Parties to Creating and Maintaining a Trust

There are typically three primary parties involved with a trust:

Grantor (or Settlor): You, the individual who creates the trust and transfers ownership of assets to it.

Trustee: The responsible party you appoint to manage the trust’s assets in accordance with your instructions. This can be a trusted friend, a family member, a professional like a lawyer or trust company, or some combination.

Beneficiary: The person or entity ultimately benefiting from the trust’s assets. This could be your children, spouse, a charity, or even a pet (in some specific instances).

Types of Trusts

Some popular types of trusts include:

Revocable Living Trusts

These trusts allow you to retain control over the assets during your lifetime while using them for your own needs. However, upon your death, the assets in a living trust typically bypass the probate process, ensuring a smoother and more private distribution to beneficiaries.

There are no other estate costs or tax implications other than saving the estate the costs and time of probate.

Irrevocable Trusts

As the name suggests, assets placed in an irrevocable trust are generally out of the grantor’s control and may offer some tax benefits.

Common examples include Irrevocable Living Trusts (ILTs) used for Medicaid planning to protect assets from nursing home costs, Irrevocable Life Insurance Trusts to keep the death benefit proceeds out of the taxable estate, and Generation-Skipping Transfer (GST) Trusts designed to minimize estate taxes for future generations. All these trusts are created as part of a comprehensive estate plan.

Special Needs Trusts

These trusts can be crucial for individuals with disabilities, safeguarding their assets while ensuring they remain eligible for essential government benefits.

What Properties Can Go into a Trust?

While most people might think trusts are primarily for housing cash and investments, in reality, they can contain just about any type of asset, including any or all of the following:

- Bank accounts

- Investments

- Real estate

- Business interests

- Life insurance policies

- Retirement accounts

- Health savings accounts

- Personal property

- Intellectual property

- Digital assets

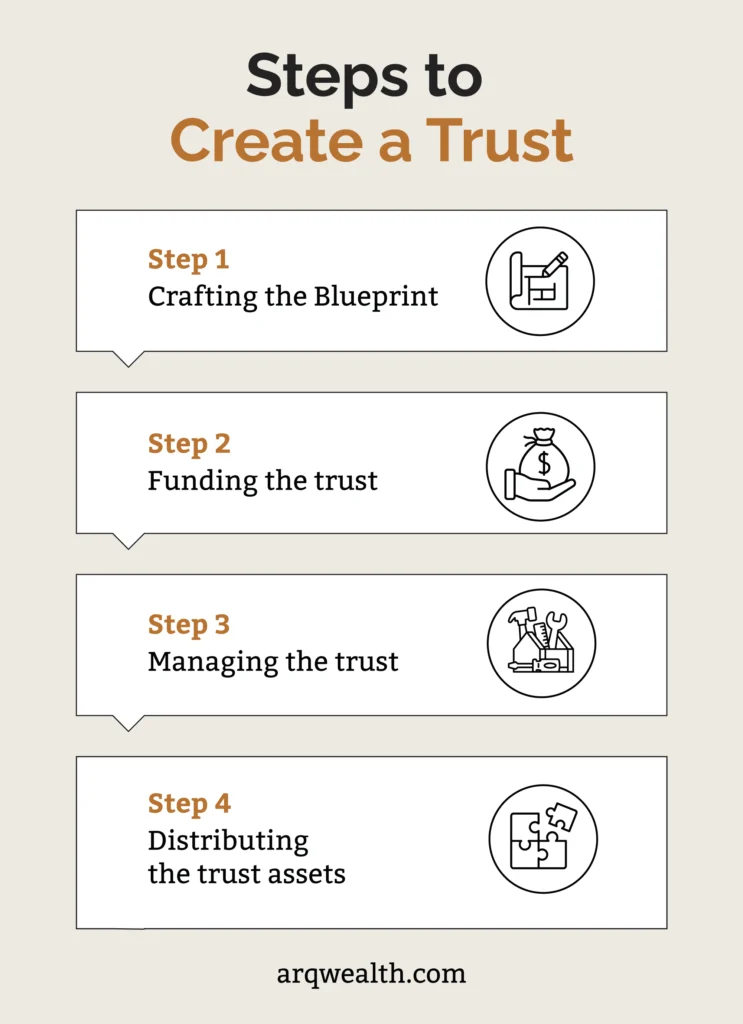

Steps to Creating and Maintaining a Trust

There are four general steps to creating and maintaining a trust:

1. Crafting the Blueprint

With the help of an estate planning attorney, you establish the trust through a legal document. This document, often called a trust deed or declaration, outlines the intended purpose for your assets in detail, specifying:

- Assets to be included: This could encompass any of the abovementioned assets.

- Management guidelines: You dictate how the trustee should handle the trust’s assets, including investment strategies and distribution rules.

- Distribution plan: This specifies how and when beneficiaries receive the trust’s assets. Will it be in a lump sum, in installments, or upon reaching a certain age? You can even set conditions for receiving benefits, such as completing education or demonstrating responsible financial management.

- Succession plan: You can designate a successor trustee if your chosen one becomes incapacitated or dies.

2. Funding the trust

Once the document is finalized, you transfer ownership of the designated assets to the trust. This is crucial, as it legally separates these assets from your personal estate.

3. Managing the trust

Upon the grantor’s death, the trustee assumes control of the trust’s assets and manages them according to the trust document. This may involve:

- Making investment decisions to grow the trust’s value.

- Paying bills on behalf of beneficiaries, especially if they are minors or lack financial responsibility.

- Distributing income generated from the trust’s assets, as specified in the document.

4. Distributing the trust assets

The trust document dictates how and when beneficiaries receive the trust’s assets. This flexibility is a crucial advantage. Here are some possibilities:

- Immediate distribution: Beneficiaries may receive the entire assets upon a specific event, such as your death.

- Staged distribution: You can structure the distribution to occur in stages, ensuring beneficiaries receive the assets at a time you deem appropriate. This can be particularly useful for young beneficiaries or situations where responsible financial management is a concern.

- Income-only distribution: Beneficiaries only receive the income generated from the trust’s assets, while the principal remains intact and can be distributed later.

The Benefits of Trusts: Beyond the Tax Breaks

While minimizing estate taxes often takes center stage when discussing trusts, the advantages extend far beyond net worth. Here’s a closer look at the diverse benefits trusts offer to individuals and families up and down the wealth ladder:

Addressing Family Dynamics

Minor children: If you have minor children, a trust can designate a guardian to manage their assets until they reach adulthood, ensuring financial stability and responsible distribution.

Special needs beneficiaries: A special needs trust can protect the assets of beneficiaries with disabilities while ensuring their eligibility for government benefits.

Blended Families or Complex Relationships: Trusts can provide clarity and minimize conflict when distributing assets in blended families or situations with estranged family members. You can clearly outline your wishes and ensure a fair and pre-determined distribution.

Desired Control and Distribution

Management during incapacity: If you become incapacitated, a designated successor trustee can manage your assets in the trust according to your wishes. This avoids court intervention and ensures your financial affairs are handled as you intended.

Controlled Distribution: Unlike wills, trusts allow you to dictate how and when beneficiaries receive assets. This is particularly helpful for young beneficiaries who might need time to mature financially or for situations where responsible distribution is crucial.

Estate Planning Goals

Avoiding probate: Probate can be a lengthy and costly process. Living trusts bypass probate court, saving court fees and ensuring assets are distributed efficiently and privately.

Goals for Higher Net Worths

As your net worth grows, additional considerations come into play:

Minimizing estate taxes: While the current estate tax exemption is high, it can change. Trusts can be used to strategically distribute assets and potentially reduce your federal estate tax burden.

Complex asset ownership: If you own a business, real estate in multiple states, or other complex assets, a trust can simplify the management and distribution process, saving time and money for your beneficiaries and avoiding potential legal complications.

Asset protection: Certain types of trusts can protect your assets from creditors or lawsuits, offering an additional layer of financial security.

Multi-generational planning: Trusts can be used to distribute wealth strategically across generations, minimizing taxes and ensuring long-term financial security for beneficiaries.

Charitable giving: Charitable trusts can be a tax-efficient way to donate to causes you care about, allowing you to fulfill your philanthropic goals while maximizing the impact of your generosity.

How Much Money Do You Need to Start a Trust?

Generally, you can create a trust with any assets, provided they have value and can be transferred to a trust. However, just because you can doesn’t necessarily mean it’s a good idea.

Trusts can be very complex, with various tax implications, so you should seek the advice of a qualified estate attorney or planner.

Determining if a Trust is Worth the Costs

Although it can be created with any amount of assets, there are initial and ongoing costs to set up a trust, potentially limiting how much value a trust can bring.

Some trusts are more complex and costly than others, making it essential to do a cost-benefit analysis before committing to one. Sometimes, the costs of setting up and maintaining a trust may exceed the benefits of addressing your needs.

For example, many people believe that having a living trust is worth it to avoid the cost and hassles of probate court. However, if the cost of probate is low in your state, paying for a trust may not be worthwhile. If the cost is high, your family could benefit from a living trust arrangement.

How Much Does a Trust Cost to Set Up?

There are a few fees to factor into the cost of creating a trust:

Setup fees

You will usually need to hire an attorney to draft the trust document and advise you on its legal aspects. Sometimes, the lawyer charges a flat fee, but you could have to pay by the hour.

In addition, depending on the type and location of the trust, you may need to pay some fees to register it with the court or the state.

Trustee fees

A trustee is needed to manage the trust and ensure your wishes are followed. This can sometimes be a family member, but you may want a professional for more complicated trusts.

A professional’s fee is generally around 0.5%–1% of the trust’s total assets.

Tax preparation fees

Depending on the type and income of the trust, you may also need to account for taxes and pay a tax professional for guidance.

Seeking Professional Guidance

Consulting an estate planning attorney and a financial advisor is crucial for creating a trust. They can assess your unique circumstances, explain the different types of trusts, and guide you toward the most suitable option for your needs and goals.

Trusts Should Be Considered as Part of an Overall Estate Plan

The decision to create a trust is deeply personal, but it should be part of an overall estate plan.

By considering your family dynamics, asset complexity, desired control over distribution, and estate planning goals, you can move beyond the net worth question and make an informed decision about safeguarding your legacy and ensuring the well-being of your loved ones.

While you will need an attorney to help you with the process, ARQ Wealth’s financial advisors can answer questions and help you put financial tools in place to help protect and share your estate.